We don’t just list your property and hope for the best. We go the extra mile to create standout listings that include video tours and detailed floor plans—at no extra cost to you. Beyond that, we leverage the power of social media to get your property noticed by the right audience. Our goal is to maximize exposure and deliver the best possible results for you.

OUR FANTASTIC PEOPLE

With over 70 years of combined experience and an unwavering commitment to providing top-notch service, our team have been living in Northamptonshire for many years and are true local experts! We are approachable, knowledgeable, and passionate about property; At the heart of everything we do is our belief in honesty and building lasting relationships.

WE AIM TO DELIVER EXCEPTIONAL MARKETING

Alongside the two main portals Rightmove & Zoopla, we go the extra mile to create standout listings by leveraging the power of social media to get your property noticed by the right audience. Our goal is to maximize exposure and deliver the best possible results for you. A Floorplan & video tour are included at no extra cost.

WE JUST GET THE JOB DONE

Our commitment doesn’t end with finding a buyer. We work diligently to ensure a smooth transaction from “Under Offer” through to completion of your sale. A dedicated estate agent's involvement can significantly impact the success of a sale, and we will delve deep down into the chain at either end to ensure we know what is going on.

WE PROMISE THERE WILL BE NO LENGTHY TIE-IN PERIODS

All we ask for is 8 weeks to sell your property. There is no lengthy sole agency tie-in period, and we offer a no sale no fee promise to all of our customers.

Click on the image below for more insight on how we can help you sell your property.

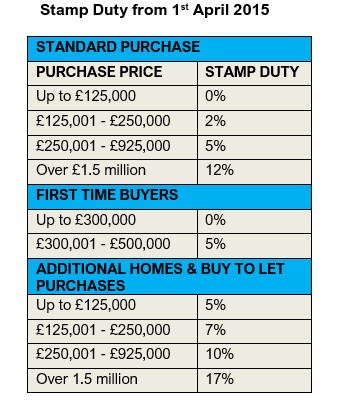

Don't forget to budget for the changes in stamp duty from 1st April 2025!

Example – if you are NOT a first-time buyer

The purchase price is £295,000. The Stamp duty you owe will be calculated as follows:

- 0% on the first £125,000 = £0.00

- 2% on the second £125,000 = £2,500

- 5% on the final £45,000 = £2,250

- Total Stamp duty due will be £4,750

Example if you are a first-time buyer

The purchase price is £500,000. The Stamp duty you owe will be calculated as follows

- 0% on the first £300,000 = £0.00

- 5% on the remaining £200,000 = £10,000

- total Stamp duty due will be £10,000

Example if you are buying as second home or a buy to let

The purchase price is £260,000. The Stamp duty you owe will be calculated as follows:

- 5% on the first £125,000 = £6,250

- 7% on the second £125,000 = £8,750

- 19% on the remaining £10,000 = £1,900

- Total Stamp duty due will be £16,900

You can use this handy calculator to work out what stamp duty you will need to pay if you purchase is set to complete after the 31st March 2025

There are different rules for corporate bodies, people who are buying 6 or more residential properties in one single transaction, if you are buying a shared ownership property, or if a company or trust is buying a residential property, click here for more details via the Government website.